The city’s Hurricane Sandy business recovery program is leaving out the little guys.

Small business owners from storm-devastated sections of Brooklyn say the disaster aid application process is too onerous for mom-and-pop shops and the criteria the city uses to determine whether businesses can pay back disaster relief loans are stacked against entrepreneurs who need help the most.

So far, the city has disbursed just $3.7 million of $42 million set aside for business recovery, according to an Department of Small Business Services spokeswoman. And many small business owners say they don’t believe they’ll ever see a dime in loans or grants.

“They are almost impossible to get,” said Monica Byrne, who owns Home Made Bklyn — a restaurant in Red Hook that suffered $100,000 in damages during and after the hurricane.

For small business owners whose ventures need around-the-clock attention, the application process — which requires extensive documentation to be hand-delivered or faxed to the city, sometimes on a short deadline — presents an incredible burden, business owners said.

“We’re talking about people working 60, 70 hours a week. It’s nearly impossible to do all the paperwork and run a business,” said Byrne, who had to hire an accountant to help her compile the mountain of documents the city requires.

Some owners don’t even get that far, due to eligibility criteria stacked against small businesses, say advocates.

“Many businesses did not apply because they were told on the spot that they weren’t eligible,” said Yelena Makhnin, director of the Brighton Beach Business Improvement District.

The solvency standards the city applies ignore the realities of small and new businesses, say local entrepreneurs.

“We’re still paying off the initial debt of opening a business — in spite of doing wildly successful over the last three years,” said Mary Dudine Kyle, owner of Dry Dock Wines and Spirits in Red Hook. “On the face of it, our balance sheet was all akilter.”

Other business owners were denied loans because they had open lines of credit — despite that being a necessary practice for most small shops.

“I do have a line of credit — you use it all the time or you’d have to go out of business,” said Tsilya Mitkovski, who owns the Best Buy International food store in Brighton Beach and said she borrows money to stock her shelves and pays it back when the merchandise moves.

The city’s Department of Small Business Services is administering the federally funded loans and grants, and it must adhere to guidelines set at the state and federal level, but business advocates and politicians are calling on the powers that be to revisit those guidelines.

“The city should work with state and federal governments to relax eligibility,” Makhnin said.

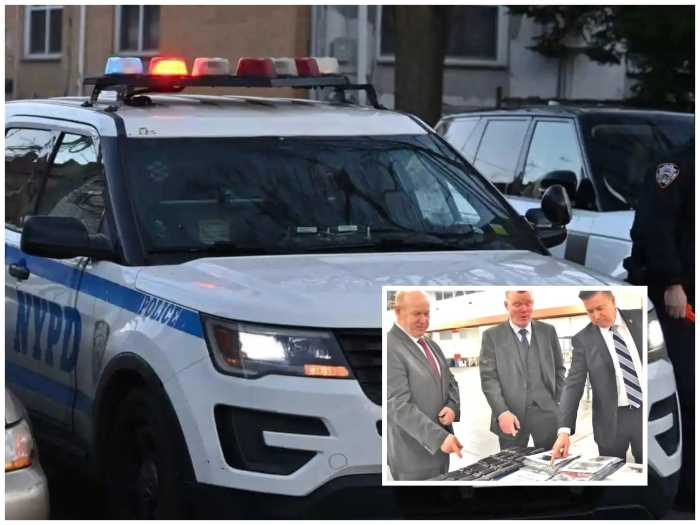

The councilman in charge of overseeing the city’s recovery programs wants to go one step further.

“Business owners need grants — not loans,” said Councilman Mark Treyger (D–Coney Island), chairman of the committee on recovery and resiliency.

The city said it is working with federal officials on “making approval guidelines more flexible.”

Left unchecked, the ham-fisted aid scheme could fundamentally change the commercial landscape in Sandy-stricken areas, say local business owners.

Byrne estimated that 65 businesses in Red Hook alone were affected by Sandy — many of which are small shops run by locals. But bigger businesses with more resources — a large staff, dedicated accountants, tax lawyers — are positioned to reap the most from the city’s aid program.

“These are not your mom-and-pops — this is not your corner bodega,” she said.

And giving priority to larger businesses will pave the way for more rapid gentrification, Byrne charged.

“It really matters that these small businesses are preserved,” she said.