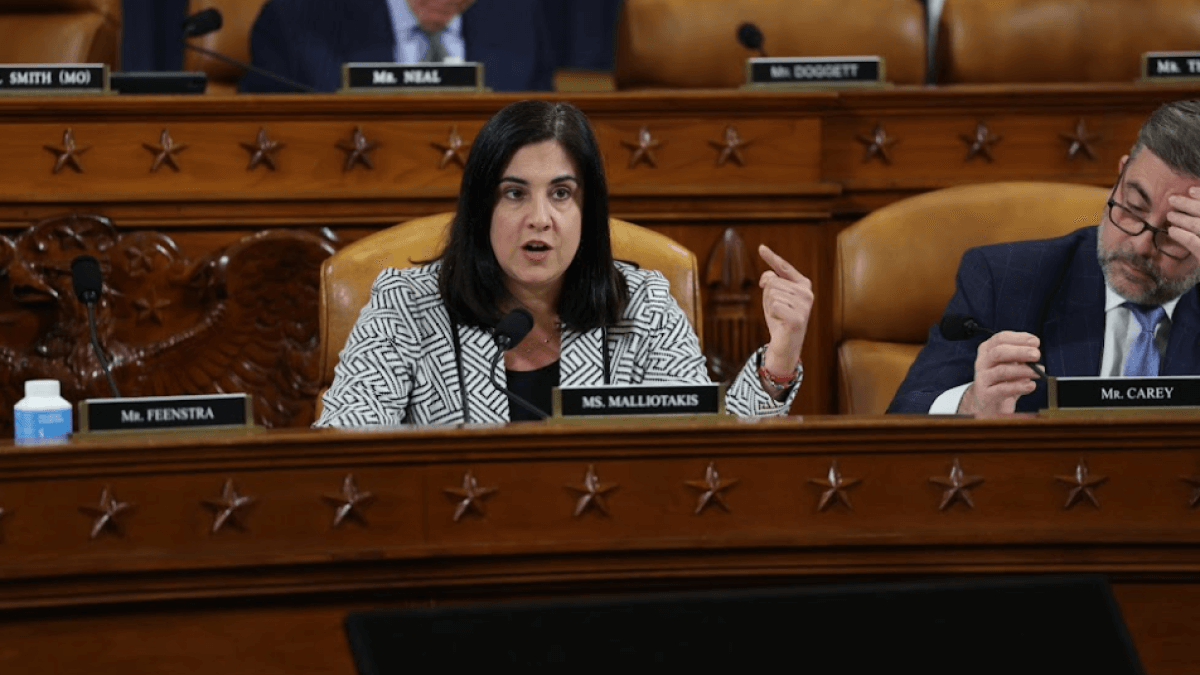

In the midst of discussions with federal regulatory bodies last month, Republican Congress Member Nicole Malliotakis purchased stock in a bank that then took over the assets of the failing Signature Bank — sending the value of her new stocks soaring.

Malliotakis purchased between $1,000-$15,000 in New York Community Bancorp shares on March 17, two days before it was announced that an NYCB subsidiary, Flagstar Bank, would take over 40 branches of Signature Bank and purchase more than $38 billion of its deposits, the Wall Street Journal first reported.

On March 20, the day after the announcement, NYCB stock rose 32%, from roughly $6.50 to $8.61 per share. State regulators seized control of Signature on March 12, after worried customers withdrew more than $10 billion after the sudden collapse of Silicon Valley Bank.

In the days leading up to the announcement, Malliotakis – a member of the House Committee on Ways and Means — had been discussing the closure of Signature Bank and its impacts with federal and state regulatory agencies.

Malliotakis represents Bay Ridge and Staten Island in the nation’s lower chamber, and has been a fixture in the dilapidated Republican Party in New York City for years, including when she was the party’s nominee for Mayor in 2017 (she ultimately lost to Bill de Blasio during his reelection campaign).

“Both last night at this morning I have been meeting with the Federal Reserve, U.S. Department of Treasury, Governor Hochul, and New York State Department of Financial Services Superintendent Adrienne Harris to discuss the closure of Signature Bank which has multiple branches that are utilized by residents and small businesses in our community,” Malliotakis said in a March 13 statement posted to Twitter. “I’ve been assured all depositors will be made whole through the Deposit Insurance Fund which is made up of contributions from all member banks, not taxpayer funds.”

A spokesperson for the congress member’s office told the Wall Street Journal she purchased the NYCB stock on the recommendation of her financial advisor, and did not learn that it would take over Signature Bank assets until the March 19 announcement. Since then, the value of NYCB stock has hovered between $8.61 and $9.14. Representatives for Malliotakis did not return request for comment.

Advocacy groups have long called for more stringent regulations on stock trading in Congress, claiming federal representatives often have inside knowledge on market fluctuations that regular investors do not, and can sell or purchase stocks to benefit themselves using that information. Under the federal STOCK Act, congress members and congressional employees are forbidden from using inside knowledge to make decisions that benefit them financially, and must publicly disclose their stock purchases and sales — but representatives frequently violate those regulations, with minimal repercussions.

“It’s unclear whether these sales reflect a conflict of interest, something more nefarious or an unfortunate coincidence, but this is exactly why members of Congress should ban buying and selling individual stocks and other securities,” said Donald Sherman, senior vice president of the watchdog group Citizens for Responsibility and Ethics in Washington. “The public shouldn’t have to wonder whether their elected representatives’ financial interests are impacting their government work.”

Malliotakis has criticized the actions of President Joe Biden and the federal reserve as inflation rates continue to rise, and claimed on March 14 that “rapidly increasing interest rates played a role in Silicon Valley Bank’s failure.”

The congress member, who represents parts of southern Brooklyn and Staten Island and recently won re-election as one of the city’s few Republican representatives, is not the only who traded stocks during the bank crisis — the Journal also reported that U.S. Rep. Earl Blumenauer, a Democrat from Oregon, sold off his Bank of America shares as panic about the stability of the country’s large banks started on March 9 — and later purchased Silicon Valley Bank stock, just before that institution went under.

According to Malliotakis’ disclosure forms from 2022, she also owns stocks in Bank of America, Con Edison, Exxon Mobil, Pfizer, and more.

Correction, 4/11/2023, 6:09pm: A previous version of this story misstated Donald Sherman’s title. We regret the error.