The rental market in Brooklyn continues to climb toward — but not yet reaching — pre-pandemic levels.

Listing inventory and new leases continue to grow at a rapid pace, while rental prices, while still down from the same time last year, are slowly ascending, according to a July rental report prepared by appraiser Jonathan Miller of Miller Samuel and published by Douglas Elliman Thursday morning.

According to Miller, the rental market in Brooklyn could see a return to normal by the start of next year.

“New leasing activity remained unusually elevated and has been driving rental prices higher,” Miller told Brownstoner in an email. “However, prices have not reached pre-COVID levels, but the gap continues to close and with billions in federal stimulus flowing through the regional economy and growing vaccine adoption. Depending on the impact of the Delta variant, the market may experience parity with rental prices before the pandemic by 2022.”

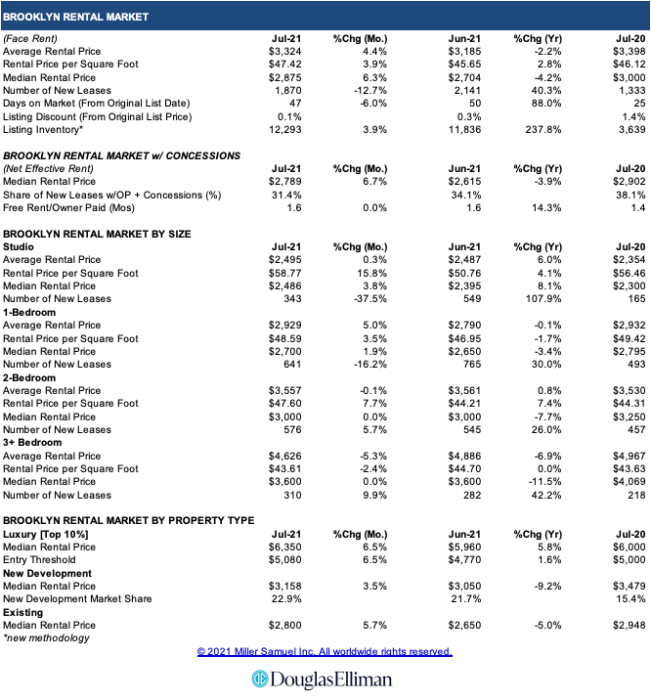

One thing is for certain: the low rents that became such a topic of conversation during the pandemic are quickly disappearing. In July, the average rental price in Brooklyn was $3,324, a decline of just 2.2 percent, or $74, from the average rental price of $3,398 in July 2020. The average rent per square foot was $47.42 in July, a growth of 2.8 percent from $46.12 the year prior.

New leases keep hitting higher peaks, with 1,870 signed in July, a 40.3 percent increase from the same period a year prior. Listing inventory also saw a massive increase of 237.8 percent since July of 2020, from 3,639 to 12,293. It’s the first annual rise in listing inventory since January of 2021, according to the report.

Interestingly, between June and July, there was a 37.5 percent decline in studio apartment new leases and a 16.2 percent decrease in new leases for one-bedroom apartments. New leases for two-bedroom apartments, meanwhile, shot up 5.7 percent, while new leases for three-bedroom apartments rose 9.9 percent during the same period, perhaps signaling a clamor for more space as back-to-office plans are stymied by the long tail of the pandemic.

This story first appeared on Brownstoner.