Call it a case of “I (should have) told you so.”

The private company that the city hired to run the billion-dollar Build It Back Hurricane Sandy recovery program — and billed the city more than $6 million for work that wasn’t up to snuff — told auditors from Comptroller Scott Stinger’s office that it wasn’t able to competently administer the program because the company lacked disaster recovery expertise.

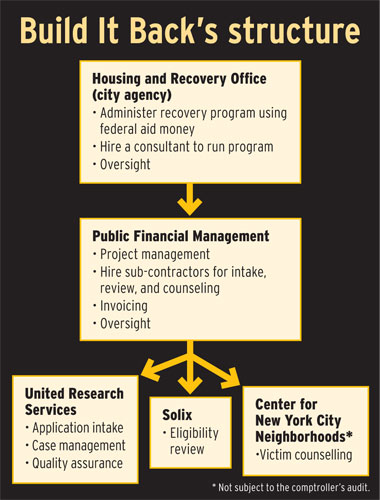

The city tapped Public Financial Management to run the federally funded program in 2012. The company hired subcontractors to handle applicants’ paperwork, but failed to make sure they were doing their jobs correctly — all while billing the city hundreds of thousands of dollars for work that had already been paid for, the audit revealed. And a manager from the company told auditors it was incapable of managing the very sub-contractors that it hired, because it lacked relevant experience.

“The manager stated that PFM was responsible for managing only the financial and administrative aspects of the program, including invoicing, monitoring program functionality, and contacting subcontractors on behalf of the city,” the audit states. “He contended that PFM was not responsible for management of the direct delivery of services because that required programmatic knowledge of disaster recovery, which he said was outside of PFM’s expertise.”

The unnamed manager later copped to dropping the ball.

“Upon further questioning, he conceded that PFM’s role as primary contractor meant that it was, by definition, responsible for subcontractor performance,” the audit states.

Public Financial Management ran the program so poorly that Mayor DeBlasio quietly axed the company in early 2014, opting to have the city oversee sub-contractors directly in the first stage of a program overhaul announced later that April.

Of the $17.25 million the city had paid consultants to run the program by March 2015, it forked over $6.8 million “for work that did not conform to program requirements set out in PFM’s contract with the city,” $1.2 million for improperly invoiced work, and an additional $245,000 for services it had already paid for, the audit found.

Public Financial Management allowed its sub-contractors to do shoddy work, frustrating aid-seekers and putting cash in hired firms’ pockets, auditors said.

The company hired United Research Services to help navigate the necessary paperwork and Solix to ensure aid-seekers were eligible for federal relief money. United Research Services received a flat $200,000 per month for its work — plus payments of $100–$300 for “deliverables” such as completing an applicant’s intake paperwork or closing out a case. But the consultants routinely filed incomplete paperwork and dragged their feet to fix it, because the monthly payment scheme gave contractors no incentive to perform more efficiently, Stringer’s office said.

But the money isn’t totally lost, according to a statement from the city’s Housing Recovery Office.

“No vendor has received payments in excess of the total amount that they are owed to date,” the statement reads. “In fact, only $17.25 million has been paid to the vendors, one-third of their original contract value. Payments made for work in 2013 will be reviewed as future payments are made to ensure that no vendor receives duplicate payments, and all future and past payments have required documentation. New comprehensive controls will ensure that no duplicate payments are made, and that any previous duplicative payments are recaptured.”